how to pay indiana state withholding tax

Once registered with the Indiana Department of Revenue they will issue the WH-1s and determine the filing status. Gasoline Use Tax GUT.

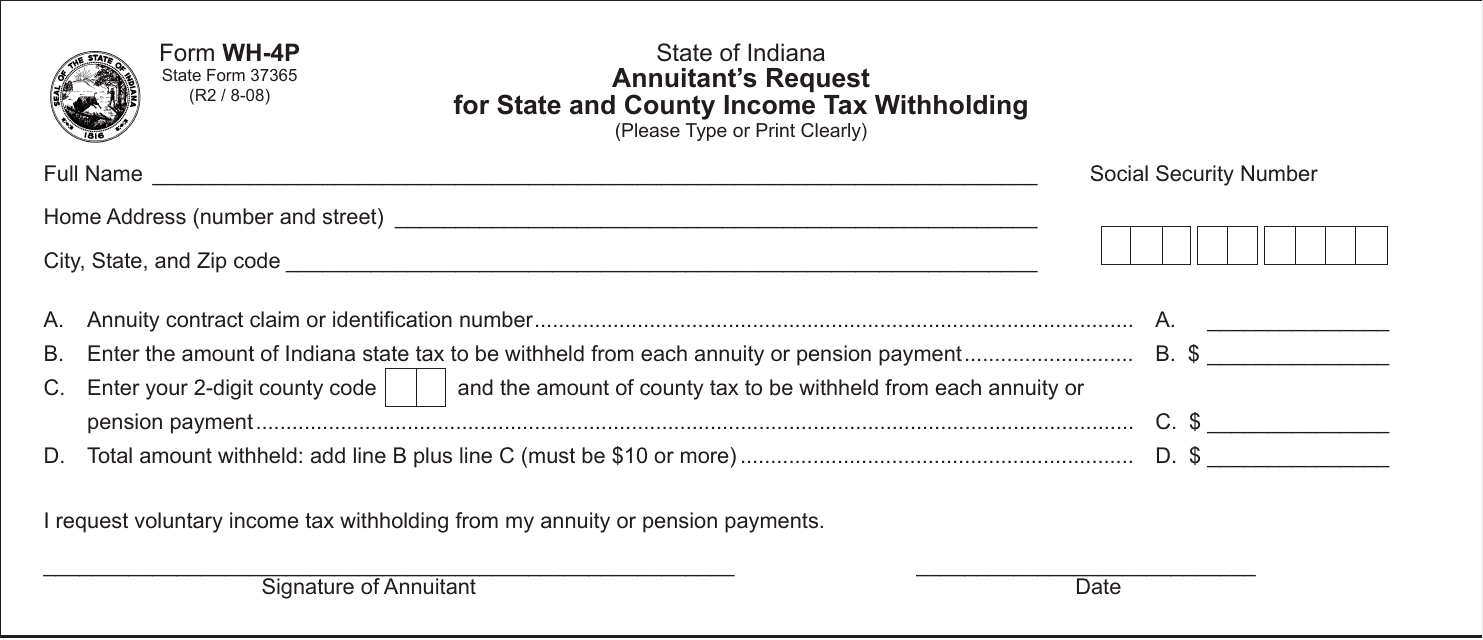

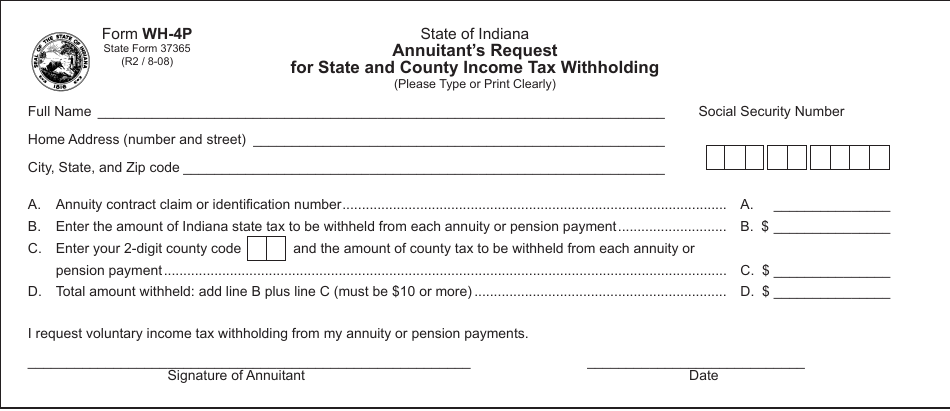

Annuitants Request for State Income Tax Withholding.

. Have more time to file my taxes and I think I will owe the Department. If your status is married filing jointly you can earn 89000 for the full deduction or 109000 for. INtax only remains available to file and pay the following tax obligations until July 8 2022.

The initial state withholding taxes are based on published guidance from each state lottery and the final state tax rates are from state government publications. Claim a gambling loss on my Indiana return. Special Fuel - SFT.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Taxpayers pay the tax as they earn or receive income during the year. Your average net per year.

Register online with the Indiana Department of Revenue on INBiz. Employees Withholding Exemption County Status Certificate. Companies who pay employees in Indiana must register with the IN Department of Revenue for a Taxpayer ID Number and the IN Department of Workforce Development for a SUTA Account Number.

Account Numbers Needed. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. Know when I will receive my tax refund.

Choose New Payment and type in. If you are mailing your Indiana return the complete filing instructions. Departmental Notice 1 explains how to withhold taxes on employees.

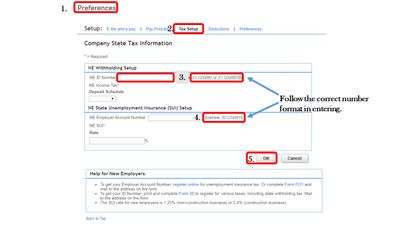

Find Indiana tax forms. Then choose From To. Option 2 is through Payroll Setup.

Businesses can close their tax accounts on INTIMEIf a business does not have an INTIME account then it is required to send an Indiana Tax Closure Request Form BC-100If the tax account isnt closed on INTIME or the BC-100 isnt filed DOR may continue to send bills for estimated taxes. IN Taxpayer ID Number. Pay my tax bill in installments.

These are state and county taxes that are withheld from your employees wages. Indiana counties local tax rates range from 050 to 290. Your child may be exempt from income tax withholding if in both the prior year and the current tax year the teen owes no federal income tax.

INTAX only remains available to file and pay special tax obligations until July 8 2022. Claim a gambling loss on my Indiana return. Form WH-1 Withholding Tax Voucher for EFT Early Filer Early Filer Monthly Annual filers.

If you cannot locate this number please call the agency at 317-233-4016. All counties in Indiana impose their own local income tax rates in addition to the state rate that everyone must pay. Click the Annual Payment Schedule link next to the state.

You will receive your Tax ID within a few hours of completing the online registration. Register with the Indiana Department of Revenue. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

Apply online using the IN BT-1 Online Application and. Transporter Tax TRP. There are income restrictions if you or your spouse has a retirement plan through your employer.

Contact the Indiana Department of Revenue DOR for further explanation if you do. However as of 2013 all Indiana withholding tax payments and WH-1s must be filed electronically. Forms required to be filed for Indiana payroll are.

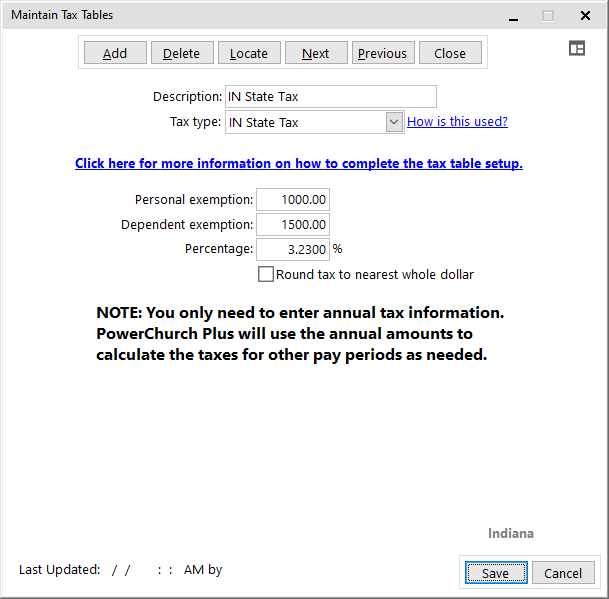

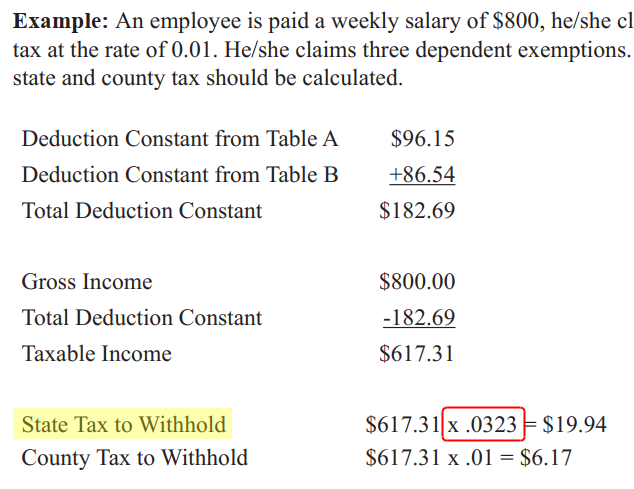

323 state tax - 246557 - 4273290. Residents of Indiana are taxed at a flat state income rate of 323. Send in a payment by the due date with a check or money order.

The county tax rate will depend on where the employee resided as of January 1. Pay my tax bill in installments. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247.

99999 99999 999 or 99999 99999 999 9 13 or 14 digits. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. As an employer you must match this tax dollar-for-dollar.

The following are the steps to make an LHDN payment using Maybank2u. Know when I will receive my tax refund. Log in to Maybank2u and choose Pay Transfer as your payment method.

From the Item Name list select Indiana Counties Tax. The aggregate of Indian state income tax and local tax applicable in a county within the state of Indiana are taken along with the allowed personal exemption and exemption for dependentsYou can also check federal paycheck tax calculator. If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am.

The state income tax rate is 323 and the sales tax rate is 7. Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check. Have more time to file my taxes and I think I will owe the Department.

When you receive a tax bill you have several options. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source. Businesses in the construction industry pay a higher starting rate The new employer rate usually remains in effect for at least 36 months.

This is where youll begin the INtax registration process. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. You must also match this tax.

Registration for withholding tax is necessary if the business has. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. However in recent years the rate has been stable at 25.

Take the renters deduction. Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form. Up to 25 cash back Here are the basic rules on Indiana state income tax withholding for employees.

For single or head of household status the limit is 56000 for a full 5000 deduction and 66000 for a partial deduction. Be aware that closing a business with DOR does not end your obligations to. Find Indiana tax forms.

That means no matter how much you make youre taxed at the same rate. If an employee resides out of state on January 1 but has his or her principal place of work or business in an Indiana county the withholding agent should withhold for. Up to 25 cash back The state UI tax rate for new employers also known as the standard rate also may change from one year to the next.

Motor Fuel - MFT. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year. INtax supports the following tax types.

430 pm EST. If you have employees working at your business youll need to collect withholding taxes. Accessing from Employee Center.

What are the payroll tax filing requirements. Take the renters deduction.

W4 Form Tax Withholding For Irs And State Income Taxes

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms State Tax Chart

Dor Indiana S Tax Dollars At Work

Powerchurch Software Church Management Software For Today S Growing Churches

Indiana W4 Pension Form Fill Online Printable Fillable Blank Pdffiller

State Form 37365 Wh 4p Download Fillable Pdf Or Fill Online Annuitant S Request For State And County Income Tax Withholding Indiana Templateroller

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Payroll Services Office Of The Controller University Of Notre Dame

How We Got Here From There A Chronology Of Indiana Property Tax Laws

State Form 37365 Wh 4p Download Fillable Pdf Or Fill Online Annuitant S Request For State And County Income Tax Withholding Indiana Templateroller

Trying To Set Up My Payroll And My State Identification Number Won T Work When I Try To Enter It In The Ne Id Number Box Why Not

I Live In Indiana And I Have Worked In Kentucky T

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Purdue University Degree Pu Diploma Buy Fake Purdue University Degree Buy Fake Pu Diploma University Degree Free Certificate Templates Usa University

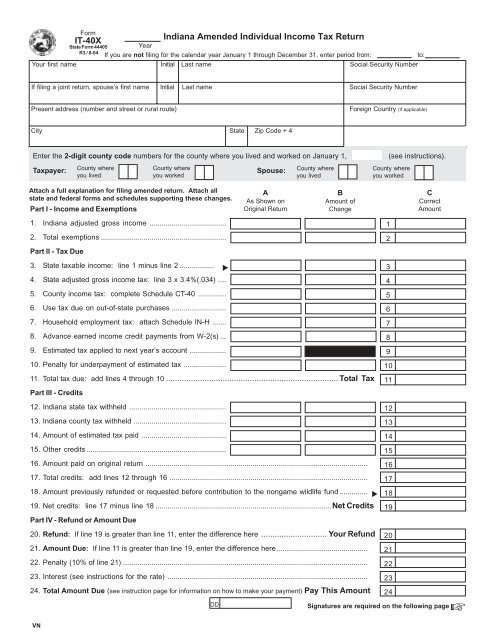

Indiana Amended Individual Income Tax Return It 40x Formsend

Powerchurch Software Church Management Software For Today S Growing Churches

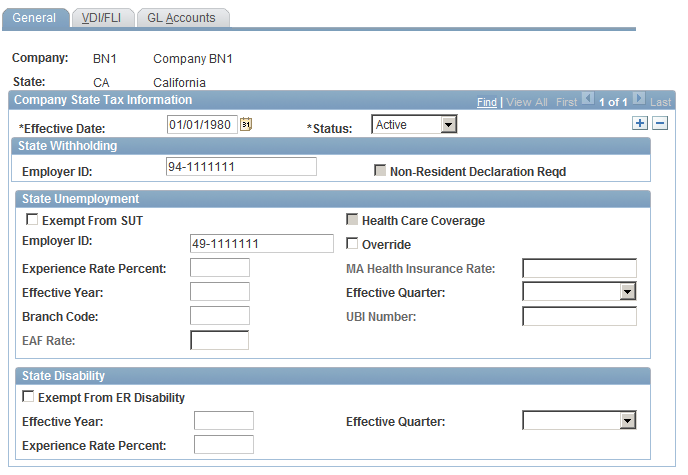

Peoplesoft Enterprise Hrms 9 1 Application Fundamentals Peoplebook